Jeanne Stansak

dylan_black_2025

Jeanne Stansak

dylan_black_2025

Introduction

Cost-benefit analysis is a technique used to evaluate the potential costs and benefits of a proposed project or policy. It involves calculating the costs associated with implementing the project or policy, as well as the expected benefits that it will bring. The goal is to determine whether the benefits of the project or policy outweigh the costs, and if so, whether it is a good investment. Cost-benefit analysis can be used in a variety of contexts, including business, government, and non-profit organizations. It can help decision-makers determine whether a proposed project or policy is likely to be successful and financially viable. By considering both the costs and benefits of a proposed project or policy, cost-benefit analysis provides a systematic way to make informed decisions about resource allocation and investment.

Explicit and Implicit Costs Costs

Explicit Costs

Explicit costs are direct monetary costs that a business incurs in the production of goods or services. These costs are easily identifiable and can be easily quantified in terms of dollars. Examples of explicit costs include the cost of raw materials, labor, rent, utilities, and insurance. These costs are typically recorded in the accounting records of a business and are used to calculate the cost of goods sold and the cost of operating the business. It is important for businesses to accurately track and manage their explicit costs in order to maximize profits and make informed decisions about resource allocation. In addition to helping businesses make financial decisions, explicit costs are also used in cost-benefit analysis to evaluate the financial viability of proposed projects or policies.

Implicit Costs

Implicit costs, also known as opportunity costs, are the indirect costs associated with using a particular resource. These costs represent the potential income or benefits that are forgone as a result of using the resource in a specific way. For example, if a business owner decides to use their own money to invest in a new project, the implicit cost is the opportunity cost of not being able to use that money for other purposes, such as saving or investing in other opportunities. Implicit costs are not directly recorded in a business's accounting records, but they can still have a significant impact on the financial performance of the business. By considering both explicit and implicit costs, businesses can make more informed decisions about how to allocate their resources and maximize profits.

Marginal Benefit and Marginal Cost

Economists talk about two types of benefit/cost: total benefit/cost and marginal benefit/cost. I'll note here also that the terms benefit and utility are interchangeable.

Total benefit and total cost is the easiest to understand, since it's just the total amount of benefit or cost you gain or give up from consuming a certain number of goods. For example, let's say I eat 5 slices of pizza. I may gain 15 utils (an imaginary unit of utility) from this in total. Similarly, it may have cost me $20 to eat all 5 slices, which is my total cost.

The marginal benefit/cost is the benefit/cost of each additional unit of a good. Using the pizza example, the first piece may have given me 8 utils, whereas the second gave me 3, the third 2, and so on. These marginal benefits add to the total benefit. Similarly, the each additional slice may cost me $4 more dollars. This is a constant marginal cost, where each additional piece of pizza costs the same as I eat more. Contrastingly, I experienced diminishing marginal utility with my pizza, since each additional slice gave me less utility than the one prior. Eventually, I may experience negative marginal utility, in which I actually lose some utility by eating pizza. This may be because I get sick after eating too many slices of pizza. This can be described by the Law of Diminishing Marginal Utility, one of the key ideas in economics.

The Law of Diminishing Marginal Utility

The law of diminishing marginal utility states that as a person consumes more of a particular good or service, the additional utility or satisfaction they derive from each additional unit will eventually decline. In other words, the first unit of a good or service may provide a lot of satisfaction, but as a person consumes more of it, the incremental benefit they receive from each additional unit will decrease.

For example, imagine that a person is hungry and has a slice of pizza. The first slice of pizza may provide a lot of satisfaction and fulfill their hunger. However, if they continue to eat slice after slice, at some point the incremental benefit they receive from each additional slice will start to decline. Eventually, they may become full and the additional slices of pizza will provide little or no additional utility.

This law is crucial in economics, and explains why we don't actively want to consume infinite goods. Eventually, it just isn't worth it!

The Cost-Benefit Maximizing Principle

When discussing marginal cost and marginal benefits, the key question that comes up is "how do we maximize total benefit?" or alternatively, "what quantity must I consume to maximize my benefits, given some costs?" It is important to note that marginal surplus is equal to MB - MC, since you gain some benefit and then lose it when you give up the costs.

This is answered by the cost-benefit maximizing principle, which states that total benefit is maximized at the quantity marginal benefit (MB) equals marginal cost (MC). Let's break this down.

At any given quantity, we have one of three scenarios: MB > MC, MB = MC, MB < MC.

When MB > MC, we are still gaining benefit overall, meaning we should rationally keep consuming. Because of diminishing marginal utility, this won't last forever, since MB is decreasing as we consume more and more.

After some threshold, MB < MC. This means we are actively losing benefit by consuming, so we shouldn't consume anywhere where MB < MC.

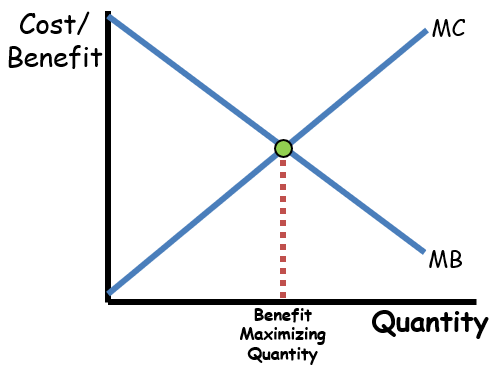

Thus, we settle where MB = MC. At this point, we shouldn't consume any more, since total surplus is zero, but we also shouldn't cut back, since we've been gaining utility up until this point. This can be seen in the following graph:

Source: ReviewEcon

To the left of the green point, MC > MC. To the right, MB < MC.

Sometimes, there isn't a quantity where MB = MC. In this case, we just consume up to and not including where MB < MC.

Sample Questions

Question 1

After graduating high school, Billy decided to enroll in a two-year program at the local community college rather than to accept an internship that offered a salary of 5,000, the annual opportunity cost of attending the community college is:

Answer

$20,000

Explanation

Opportunity cost includes both explicit and implicit costs. In this question, the 5,000 in tuition and fees is the explicit cost of going to the community college.

Question 2

All of the following are included in computing the opportunity cost of attending college EXCEPT:

(A) interest paid on student loans

(B) wages the student gave up to attend college

(C) money spent on books and supplies

(D) money spent on college tuition

(E) money spent on clothing expenses

Answer

Choice E

Explanation

No matter what decision you make, you will always have clothing expenses.

Question 3

Sylvia works part-time at a local convenience store and earns 100, but Sylvia was able to get a discounted price of $75 from her cousin who purchased the ticket and is unable to attend. If Sylvia took 5 hours off from her job to attend the sporting event, what was her opportunity cost of attending the concert?

Answer

$135

Explanation

Sylvia would have earned 75 on the ticket (explicit cost). 60 + 75 = 135.

Question 4

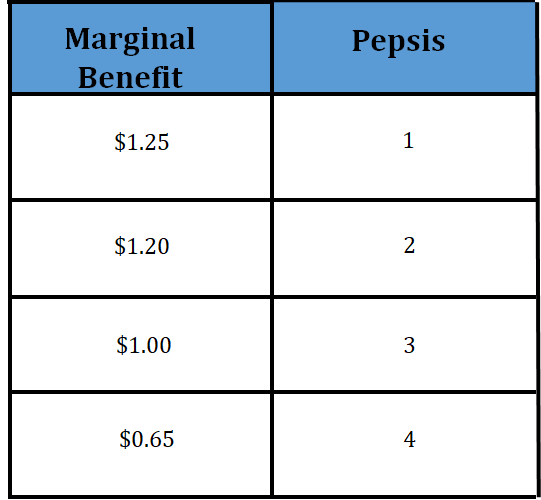

Jane’s marginal benefit per day from drinking Pepsi is given in the table below. The table shows that she values the first Pepsi she drinks at 1.20, and so on. If the price of a Pepsi is $1.00, how many should Jane drink?

Answer

3 Pepsis

Explanation

The optimal number of Pepsis that Jane should drink is 3 because that is where marginal cost (0.25 of surplus. For the second, 0.00. After this, she is gaining less than she pays for a Pepsi, so it makes no sense for her to buy the fourth Pepsi. Imagine paying 0.65. It doesn't make rational sense!

<< Hide Menu

Jeanne Stansak

dylan_black_2025

Jeanne Stansak

dylan_black_2025

Introduction

Cost-benefit analysis is a technique used to evaluate the potential costs and benefits of a proposed project or policy. It involves calculating the costs associated with implementing the project or policy, as well as the expected benefits that it will bring. The goal is to determine whether the benefits of the project or policy outweigh the costs, and if so, whether it is a good investment. Cost-benefit analysis can be used in a variety of contexts, including business, government, and non-profit organizations. It can help decision-makers determine whether a proposed project or policy is likely to be successful and financially viable. By considering both the costs and benefits of a proposed project or policy, cost-benefit analysis provides a systematic way to make informed decisions about resource allocation and investment.

Explicit and Implicit Costs Costs

Explicit Costs

Explicit costs are direct monetary costs that a business incurs in the production of goods or services. These costs are easily identifiable and can be easily quantified in terms of dollars. Examples of explicit costs include the cost of raw materials, labor, rent, utilities, and insurance. These costs are typically recorded in the accounting records of a business and are used to calculate the cost of goods sold and the cost of operating the business. It is important for businesses to accurately track and manage their explicit costs in order to maximize profits and make informed decisions about resource allocation. In addition to helping businesses make financial decisions, explicit costs are also used in cost-benefit analysis to evaluate the financial viability of proposed projects or policies.

Implicit Costs

Implicit costs, also known as opportunity costs, are the indirect costs associated with using a particular resource. These costs represent the potential income or benefits that are forgone as a result of using the resource in a specific way. For example, if a business owner decides to use their own money to invest in a new project, the implicit cost is the opportunity cost of not being able to use that money for other purposes, such as saving or investing in other opportunities. Implicit costs are not directly recorded in a business's accounting records, but they can still have a significant impact on the financial performance of the business. By considering both explicit and implicit costs, businesses can make more informed decisions about how to allocate their resources and maximize profits.

Marginal Benefit and Marginal Cost

Economists talk about two types of benefit/cost: total benefit/cost and marginal benefit/cost. I'll note here also that the terms benefit and utility are interchangeable.

Total benefit and total cost is the easiest to understand, since it's just the total amount of benefit or cost you gain or give up from consuming a certain number of goods. For example, let's say I eat 5 slices of pizza. I may gain 15 utils (an imaginary unit of utility) from this in total. Similarly, it may have cost me $20 to eat all 5 slices, which is my total cost.

The marginal benefit/cost is the benefit/cost of each additional unit of a good. Using the pizza example, the first piece may have given me 8 utils, whereas the second gave me 3, the third 2, and so on. These marginal benefits add to the total benefit. Similarly, the each additional slice may cost me $4 more dollars. This is a constant marginal cost, where each additional piece of pizza costs the same as I eat more. Contrastingly, I experienced diminishing marginal utility with my pizza, since each additional slice gave me less utility than the one prior. Eventually, I may experience negative marginal utility, in which I actually lose some utility by eating pizza. This may be because I get sick after eating too many slices of pizza. This can be described by the Law of Diminishing Marginal Utility, one of the key ideas in economics.

The Law of Diminishing Marginal Utility

The law of diminishing marginal utility states that as a person consumes more of a particular good or service, the additional utility or satisfaction they derive from each additional unit will eventually decline. In other words, the first unit of a good or service may provide a lot of satisfaction, but as a person consumes more of it, the incremental benefit they receive from each additional unit will decrease.

For example, imagine that a person is hungry and has a slice of pizza. The first slice of pizza may provide a lot of satisfaction and fulfill their hunger. However, if they continue to eat slice after slice, at some point the incremental benefit they receive from each additional slice will start to decline. Eventually, they may become full and the additional slices of pizza will provide little or no additional utility.

This law is crucial in economics, and explains why we don't actively want to consume infinite goods. Eventually, it just isn't worth it!

The Cost-Benefit Maximizing Principle

When discussing marginal cost and marginal benefits, the key question that comes up is "how do we maximize total benefit?" or alternatively, "what quantity must I consume to maximize my benefits, given some costs?" It is important to note that marginal surplus is equal to MB - MC, since you gain some benefit and then lose it when you give up the costs.

This is answered by the cost-benefit maximizing principle, which states that total benefit is maximized at the quantity marginal benefit (MB) equals marginal cost (MC). Let's break this down.

At any given quantity, we have one of three scenarios: MB > MC, MB = MC, MB < MC.

When MB > MC, we are still gaining benefit overall, meaning we should rationally keep consuming. Because of diminishing marginal utility, this won't last forever, since MB is decreasing as we consume more and more.

After some threshold, MB < MC. This means we are actively losing benefit by consuming, so we shouldn't consume anywhere where MB < MC.

Thus, we settle where MB = MC. At this point, we shouldn't consume any more, since total surplus is zero, but we also shouldn't cut back, since we've been gaining utility up until this point. This can be seen in the following graph:

Source: ReviewEcon

To the left of the green point, MC > MC. To the right, MB < MC.

Sometimes, there isn't a quantity where MB = MC. In this case, we just consume up to and not including where MB < MC.

Sample Questions

Question 1

After graduating high school, Billy decided to enroll in a two-year program at the local community college rather than to accept an internship that offered a salary of 5,000, the annual opportunity cost of attending the community college is:

Answer

$20,000

Explanation

Opportunity cost includes both explicit and implicit costs. In this question, the 5,000 in tuition and fees is the explicit cost of going to the community college.

Question 2

All of the following are included in computing the opportunity cost of attending college EXCEPT:

(A) interest paid on student loans

(B) wages the student gave up to attend college

(C) money spent on books and supplies

(D) money spent on college tuition

(E) money spent on clothing expenses

Answer

Choice E

Explanation

No matter what decision you make, you will always have clothing expenses.

Question 3

Sylvia works part-time at a local convenience store and earns 100, but Sylvia was able to get a discounted price of $75 from her cousin who purchased the ticket and is unable to attend. If Sylvia took 5 hours off from her job to attend the sporting event, what was her opportunity cost of attending the concert?

Answer

$135

Explanation

Sylvia would have earned 75 on the ticket (explicit cost). 60 + 75 = 135.

Question 4

Jane’s marginal benefit per day from drinking Pepsi is given in the table below. The table shows that she values the first Pepsi she drinks at 1.20, and so on. If the price of a Pepsi is $1.00, how many should Jane drink?

Answer

3 Pepsis

Explanation

The optimal number of Pepsis that Jane should drink is 3 because that is where marginal cost (0.25 of surplus. For the second, 0.00. After this, she is gaining less than she pays for a Pepsi, so it makes no sense for her to buy the fourth Pepsi. Imagine paying 0.65. It doesn't make rational sense!

© 2024 Fiveable Inc. All rights reserved.