Browse By Unit

6.4 Effect of Changes in Policies & Economic Conditions on the Foreign Exchange Market

6 min read•june 18, 2024

Jeanne Stansak

Haseung Jun

Jeanne Stansak

Haseung Jun

Policies and the Foreign Exchange Market

Change in Demand or Supply in Currency

There are four determinants that can change either the supply or demand in the FOREX Market. These include:

Let's look at some scenarios that fall into these different determinants and see how they affect the various currencies.

-

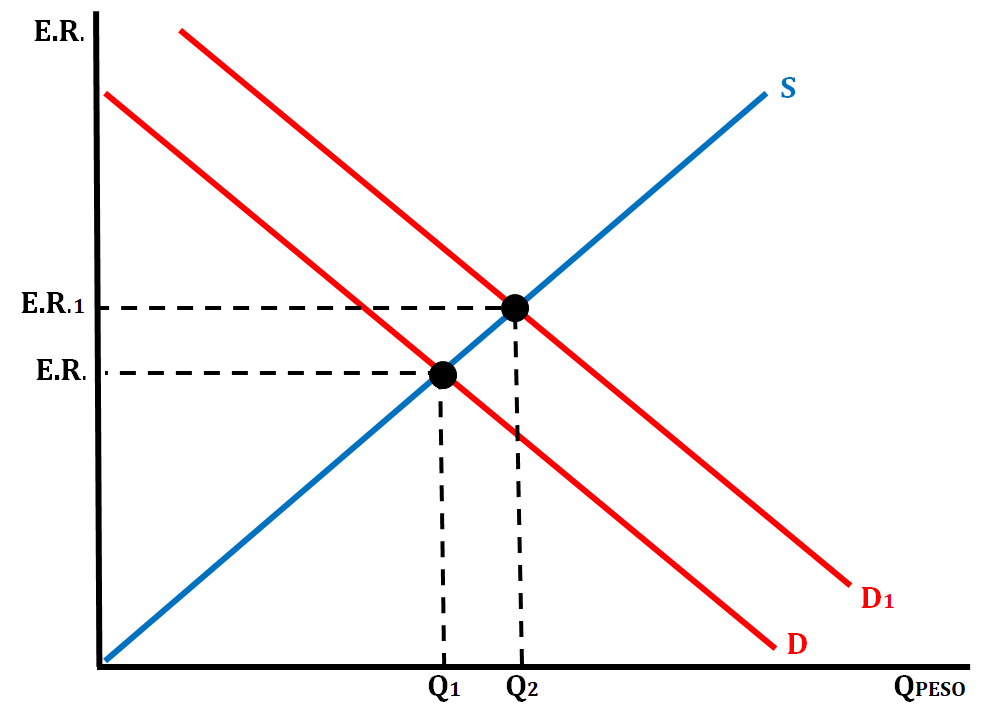

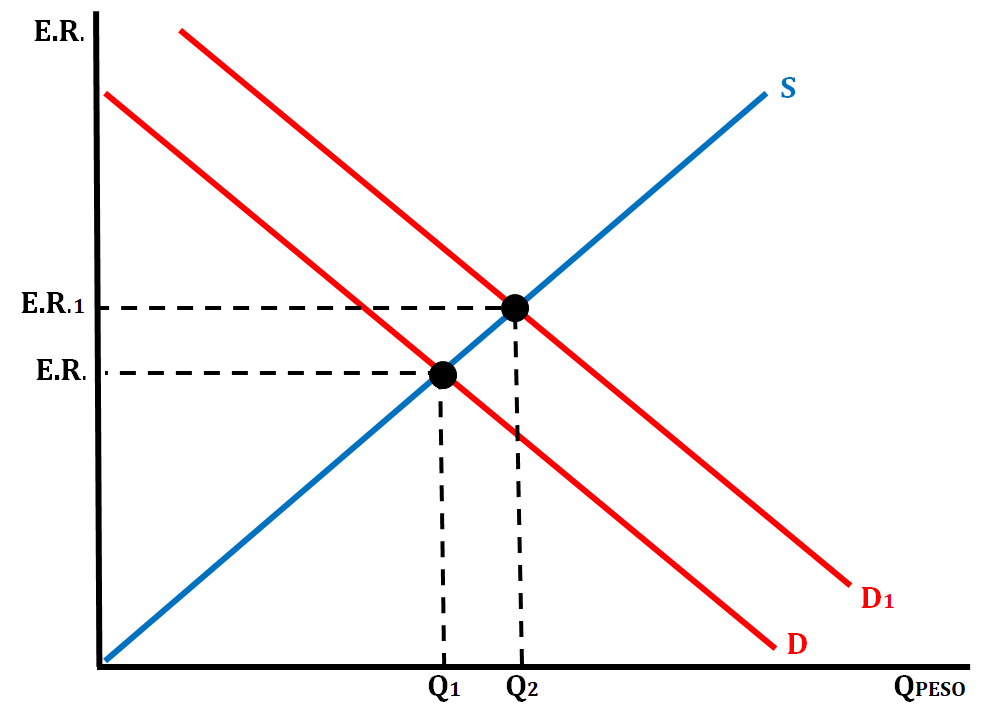

Scenario # 1: Tourists from all over the world travel to Mexico for Vacation.

-

The demand for the peso will increase and the peso will appreciate. Appropriately, demand will shift to the right.

-

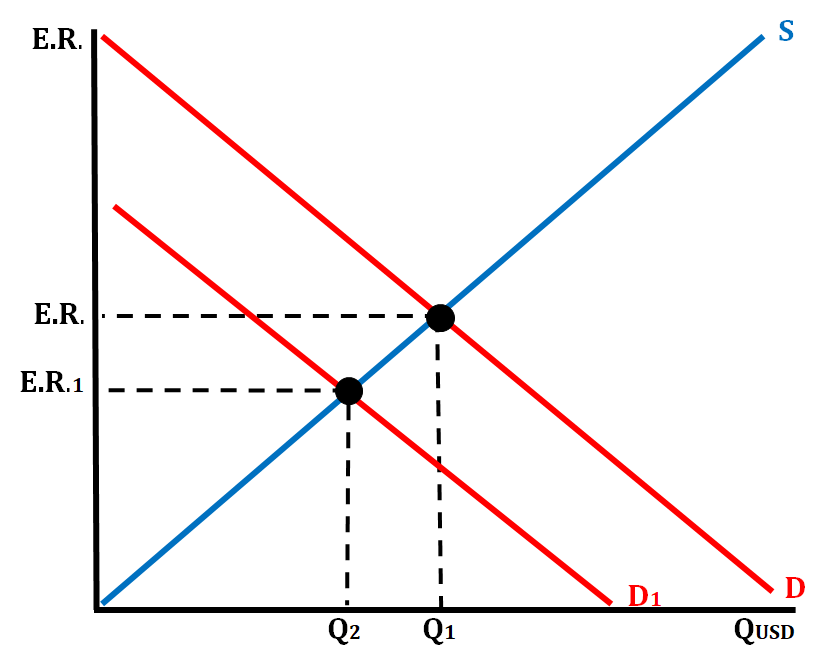

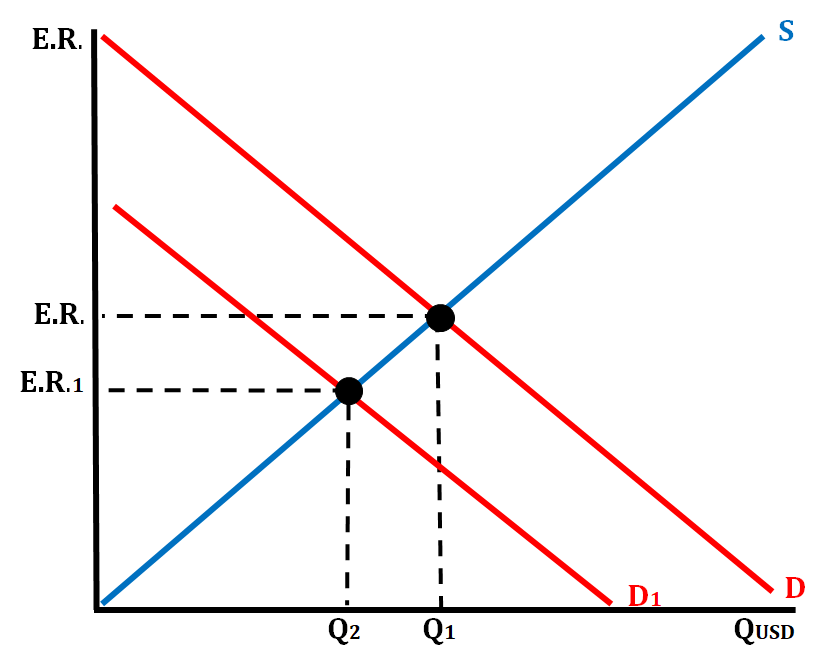

Scenario # 2: The price of U.S. exports increase. How would this affect the demand for the U.S. dollar?- It would cause the demand for U.S. goods to decrease which would cause the demand for the dollar to decrease. The U.S. Dollar would depreciate. Appropriately, demand will shift left.

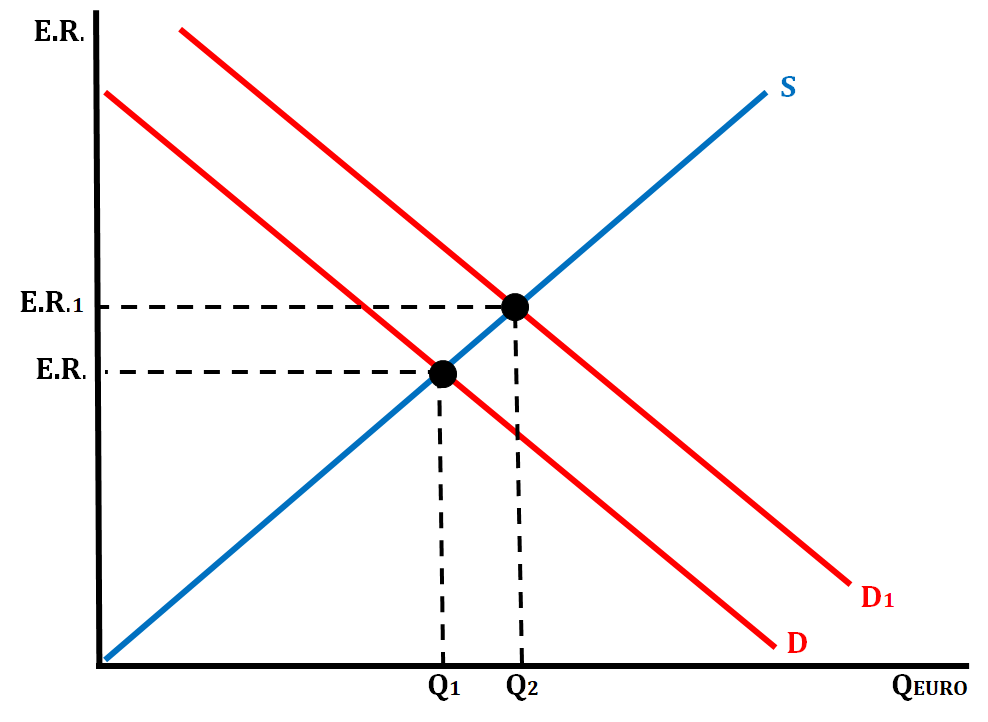

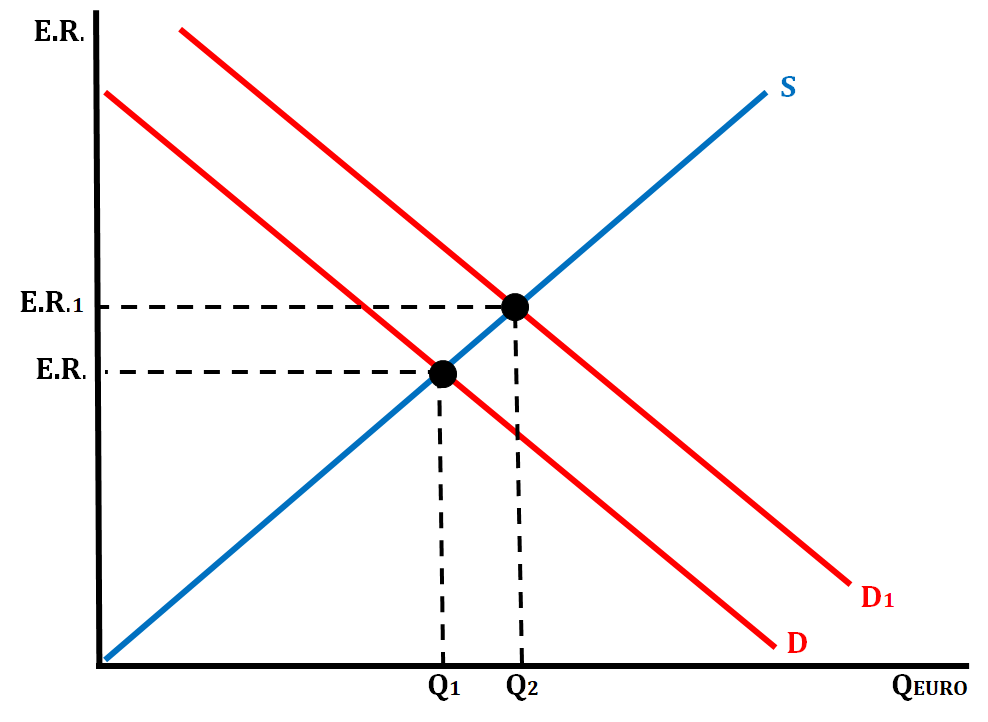

- Scenario # 3: An economic boom causes income levels to increase for Chinese consumers causing them to increase their demand for Germany goods.- The demand for the Euro will increase, as they need to convert the Yen to Euros. The Euro will appreciate because a shift of demand to the right.

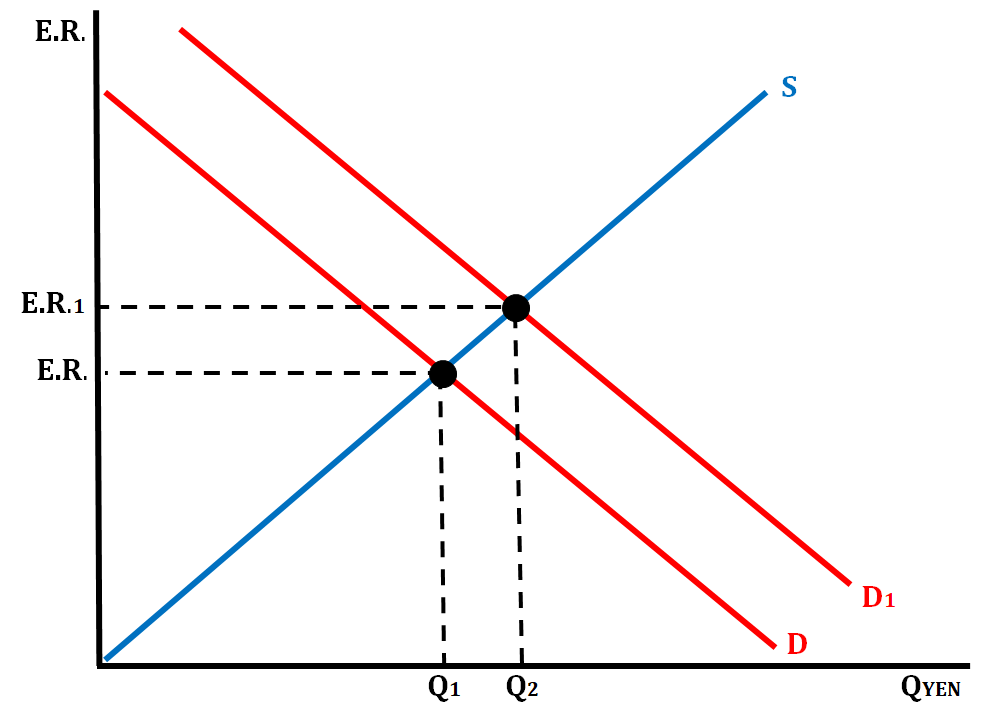

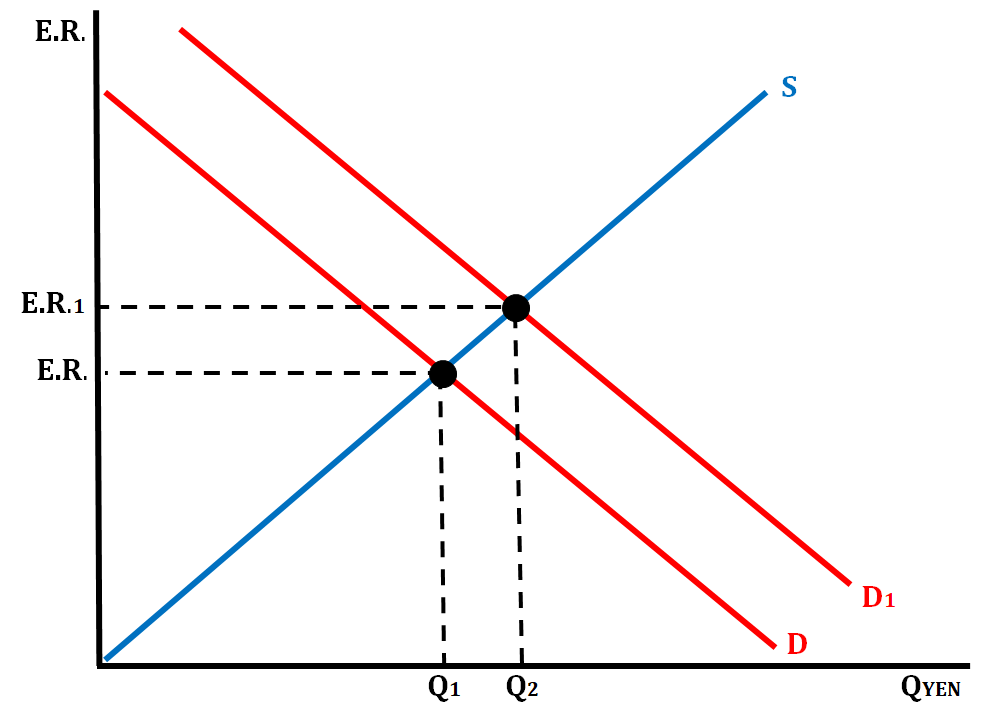

- Scenario # 4: Japanese real interest rates are higher than interest rates in the United States.- The demand for the Yen will increase and the Yen will appreciate.

Fiscal Policy Impact on Exchange Rates

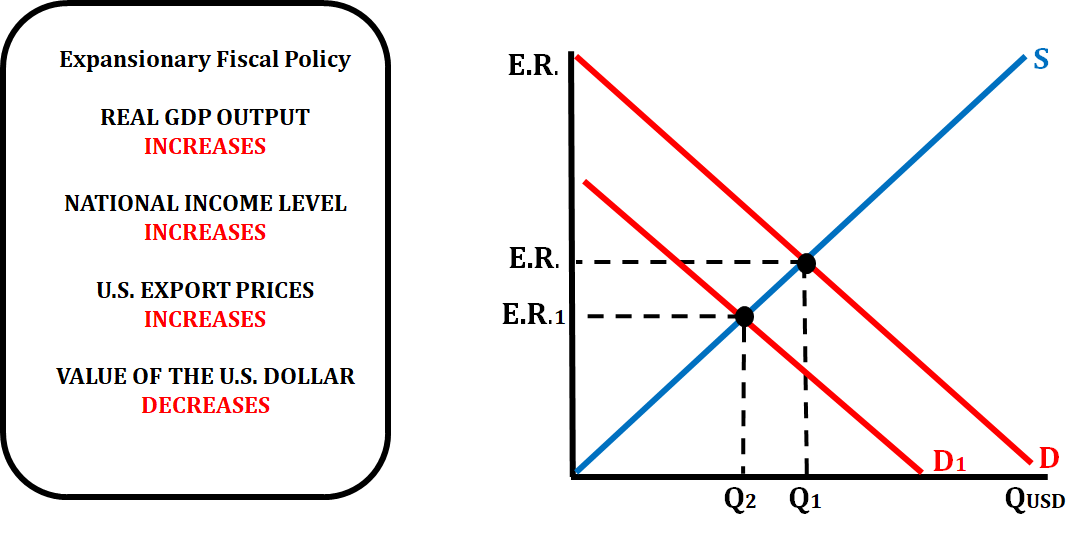

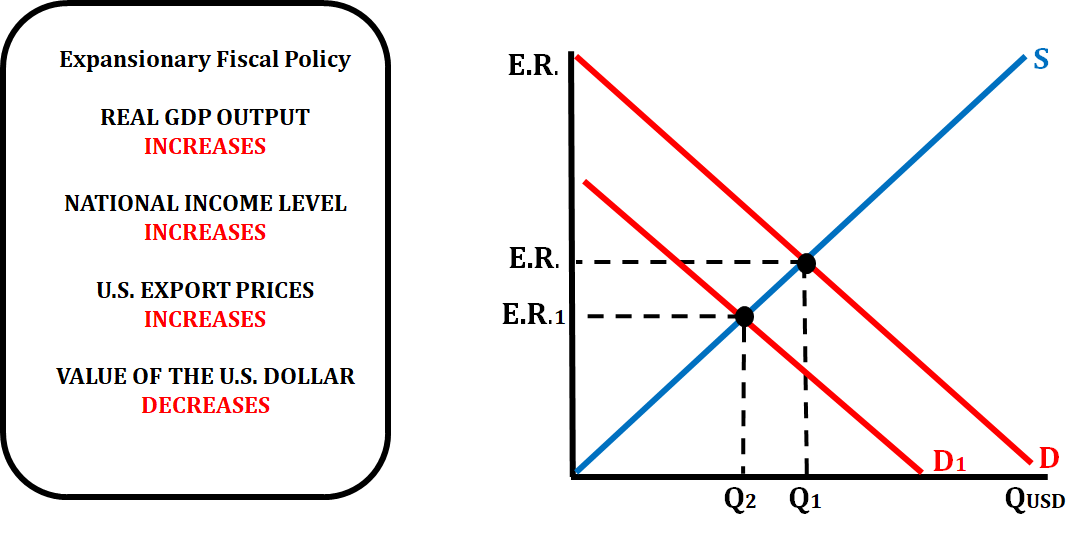

When the government practices an expansionary fiscal policy (increase in spending or decrease in taxes), there is an effect on the exchange rate for that country's currency. The example below shows what would happen if this occurs in the United States.

If the government increases spending or decreases taxes, aggregate demand (AD) will increase, which will increase real GDP output and increase the price level. This makes U.S. goods more expensive which means that other countries will not buy as much. So, there will be less of a demand for the U.S. dollar which will depreciate it.

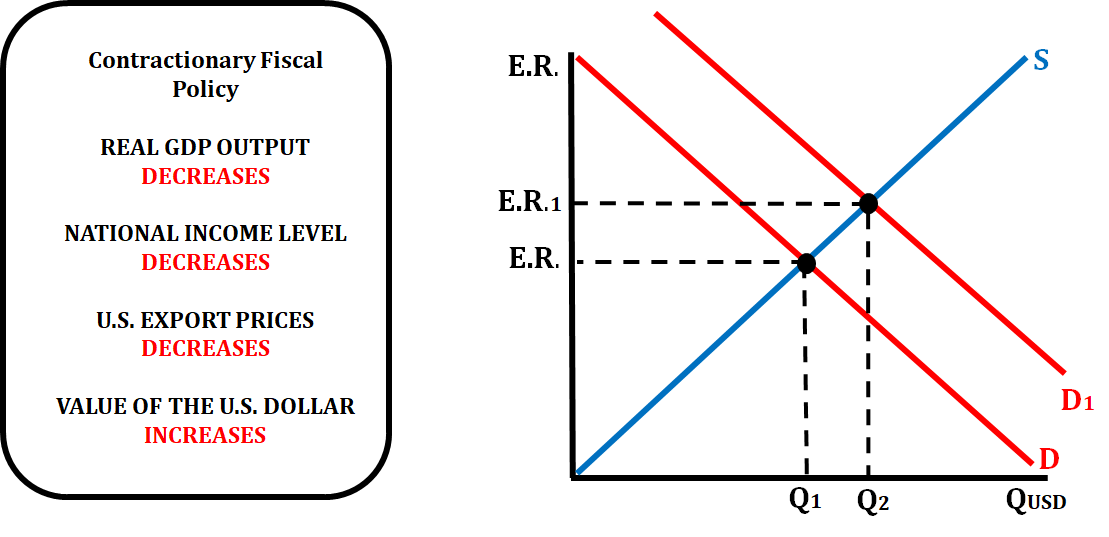

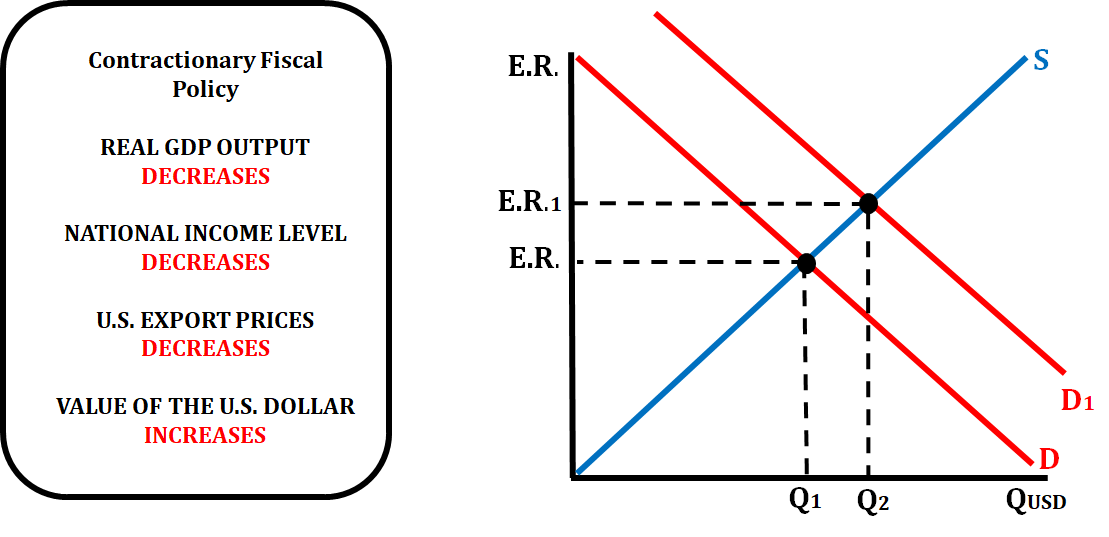

When the government practices a contractionary fiscal policy (decreases spending or increases taxes), there is an effect on the exchange rate of that country's currency. The example below shows what would happen if this occurs in the United States.

If the government either decreases spending or increases taxes, that will decrease aggregate demand which will decrease real GDP output and decrease price level. This will make U.S. goods less expensive which will make them more attractive to foreign consumers. Foreign consumers will increase their purchases of U.S. goods and will need to exchange their currency for the dollar which will increase the demand for the dollar. When the demand for the dollar increases, the value of the dollar will appreciate.

Monetary Policy Impact on Exchange Rates

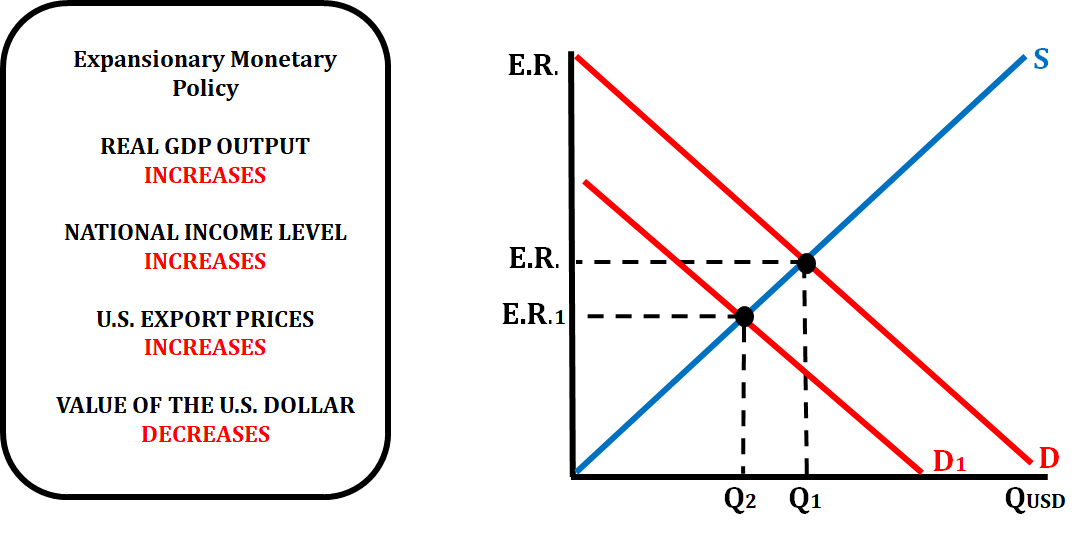

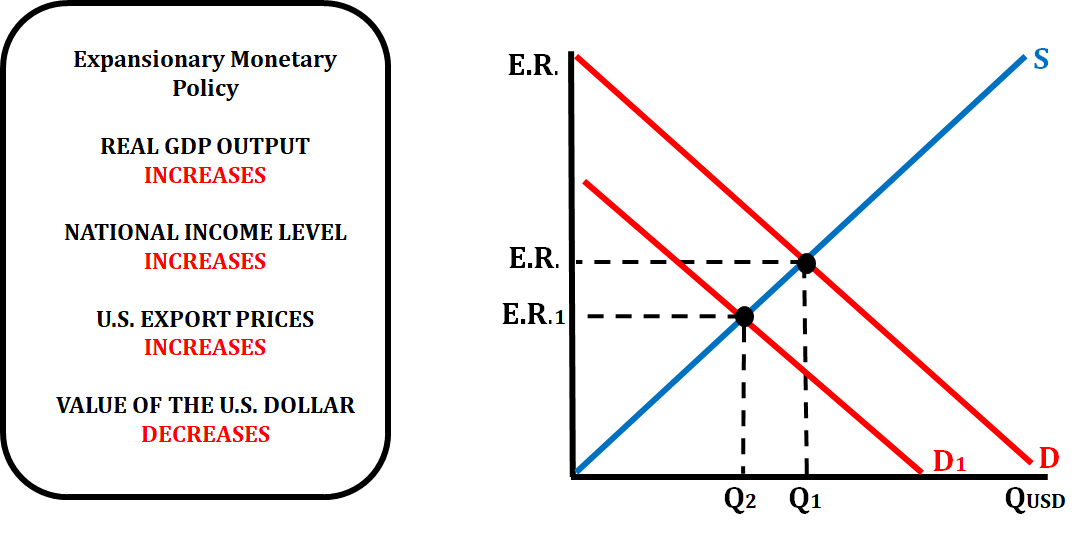

If the central bank of a country is practicing an expansionary monetary policy (decreasing the reserve ratio, decreasing the discount rate, or buy bonds) it will have an effect on the exchange rate as well. In the following example, we are looking at the actions of the Federal Reserve in the United States.

When the FED increases the money supply, that lowers the interest rate which will increase investment spending. When investment spending increases, aggregate demand increases which raises the price level. This means that both the national income levels and export prices will increase. With the U.S. good at higher prices, foreign customers do not want to buy the goods which will decrease the demand for the U.S. dollar, causing a depreciation of the U.S. dollar.

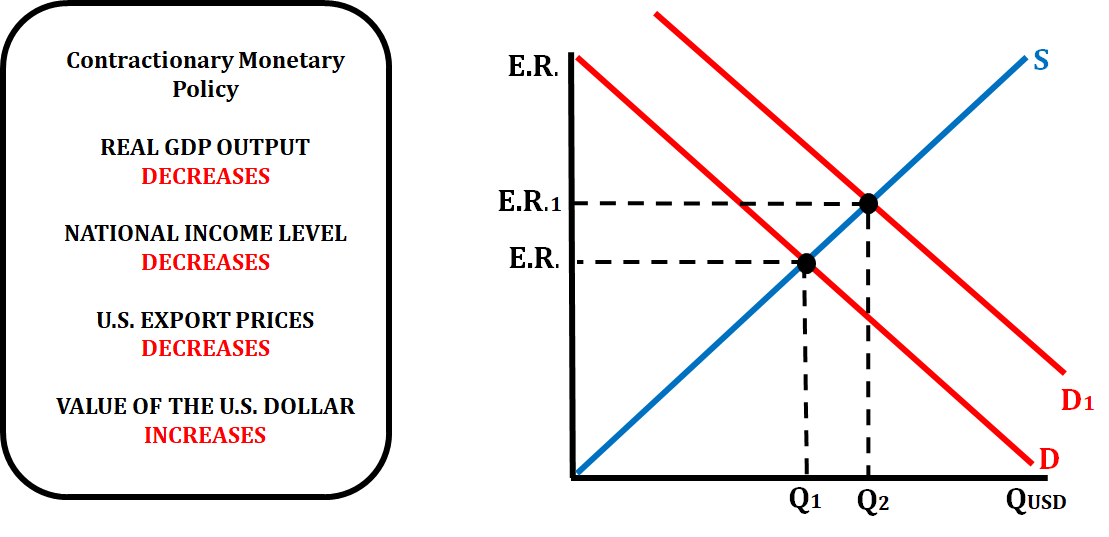

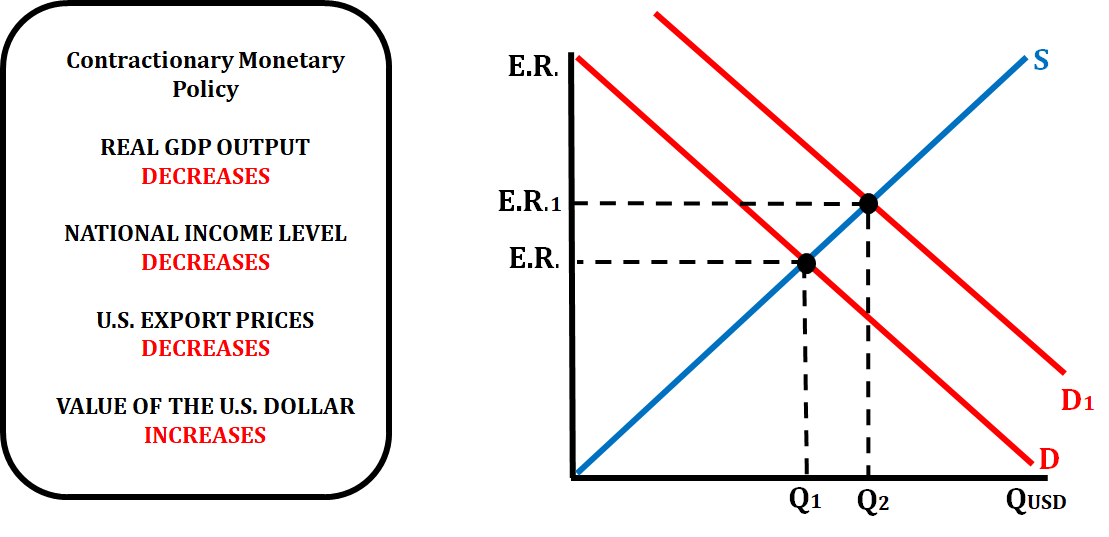

If the central bank of a country is practicing a contractionary monetary policy (increasing the reserve ratio, increasing the discount rate, or selling bonds), it will have an effect on the value of the exchange rate. In the following example, we are looking at the actions of the Federal Reserve in the United States.

When the FED decreases the money supply, that raises the interest rate which will decrease investment spending. When investment spending decreases, aggregate demand decreases which lower the price level. This means that both the national income levels and export prices will decrease. With the U.S. goods at lower prices, foreign customers want to buy the goods which will increase the demand for the U.S. dollar, causing an appreciation of the U.S. dollar.

Trade Barriers

Why do we have trade barriers? Most economists argue that free trade benefits both nations. So why do we have tariffs and quotas? Most economists say that's it's because it costs domestic jobs in the higher-wage nation.

China has a lower wage than the US. If China and the US have a free trade, many of American jobs will be lost because (remember supply and demand) more people in America will favor Chinese products over American products due to low prices (since China has low wages). This will lead to a decrease in profits for American businesses and workers will be laid off because firms will start cutting back on spending.

This is why trade barriers are mostly paced. It's to protect domestic jobs.

Trade barriers are not a Macro only topic, so if you're taking Micro too, you're gonna like it!

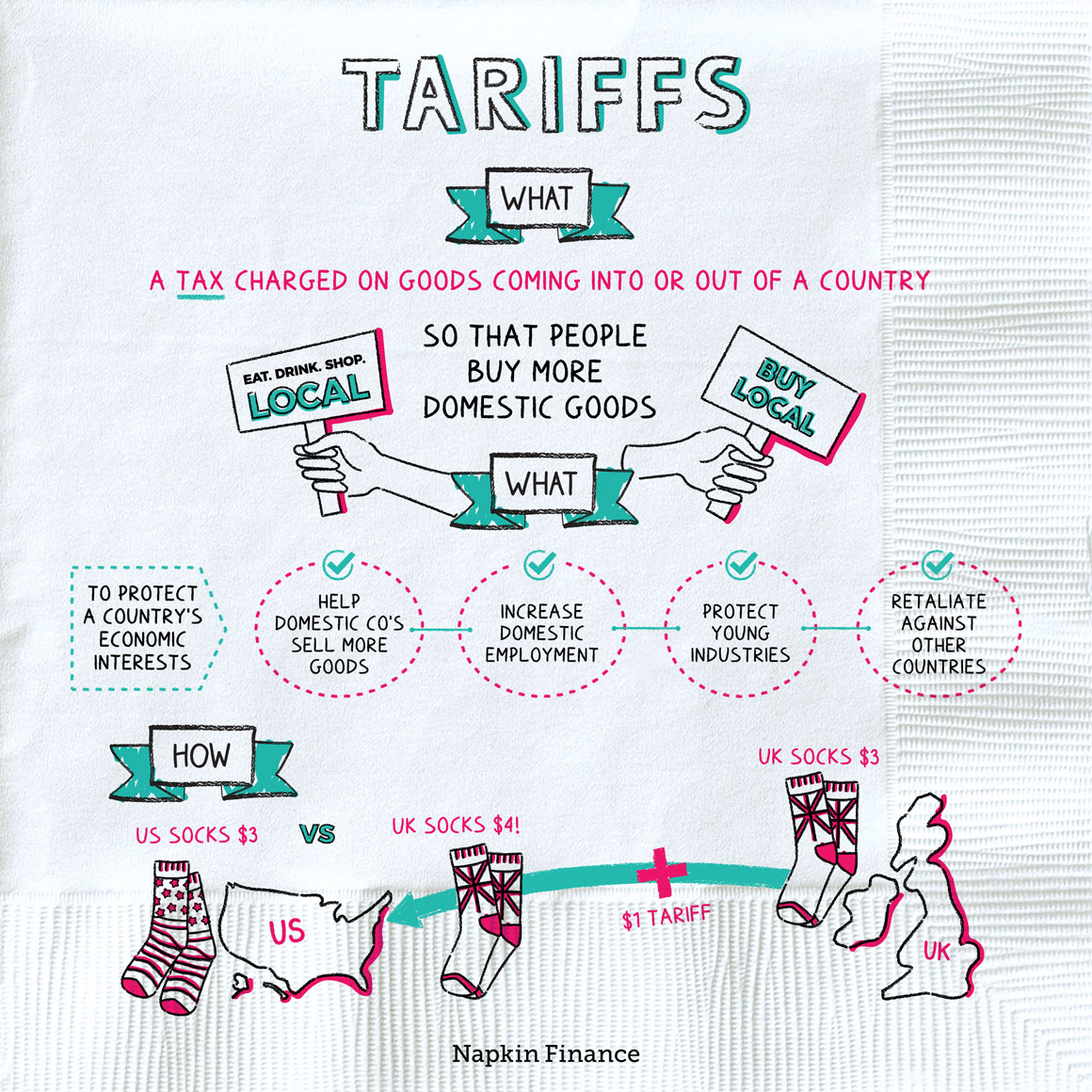

Tariffs

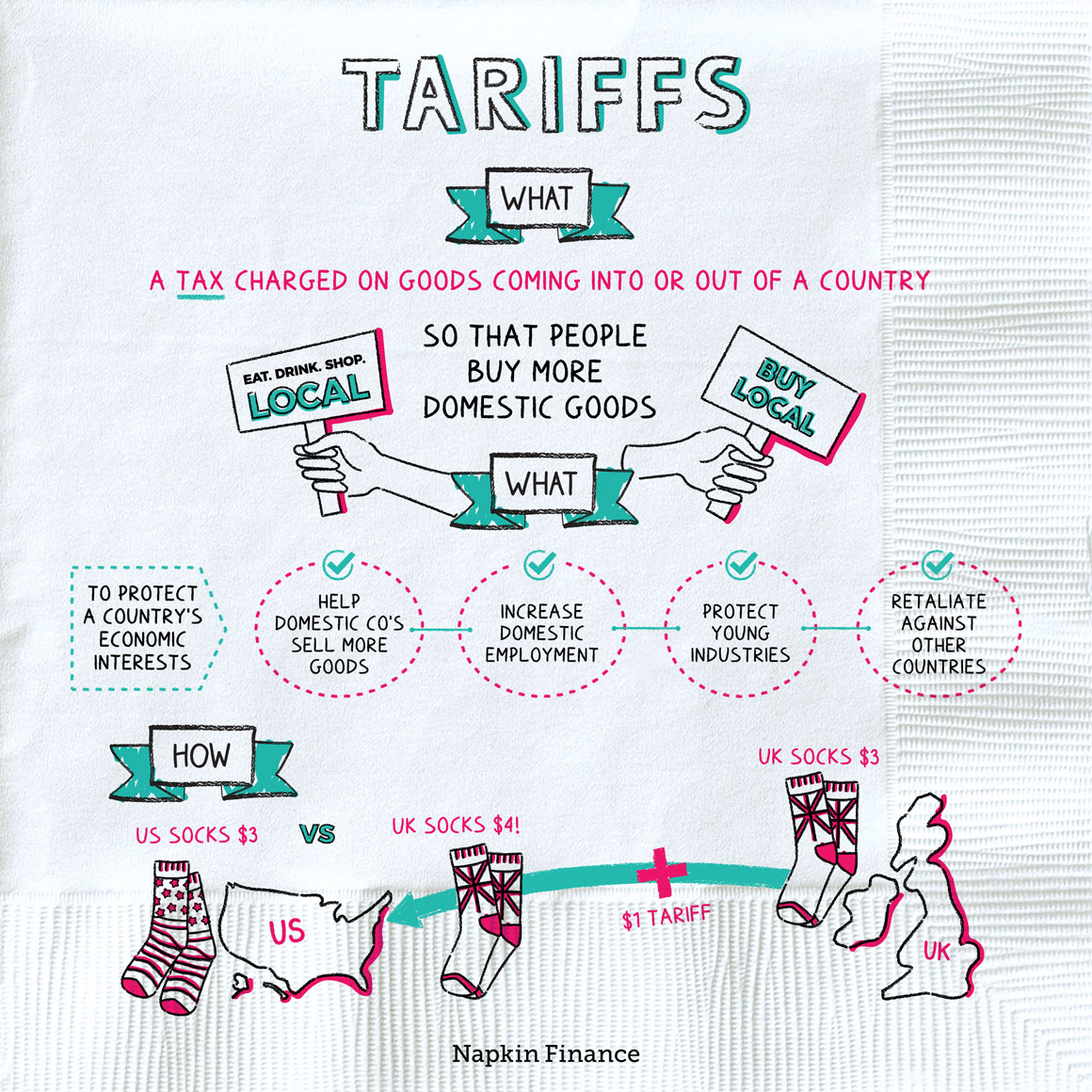

There are two types of tariffs. Revenue tariffs and protective tariffs. Revenue tariffs are taxes imposed on goods that were not produced domestically. These tariffs would be imposed on bananas, for example, since the US does not produce bananas. This wouldn't necessarily cause a big impact on the economy since the US doesn't produce bananas so there are no domestic jobs to protect. Instead, it's just there to raise government revenue.

Protective tariffs, on the other hand, are taxes imposed on goods that are produced domestically. These tariffs are the protect-domestic-jobs kind of tariffs.

Image Courtesy of Napkin Finance

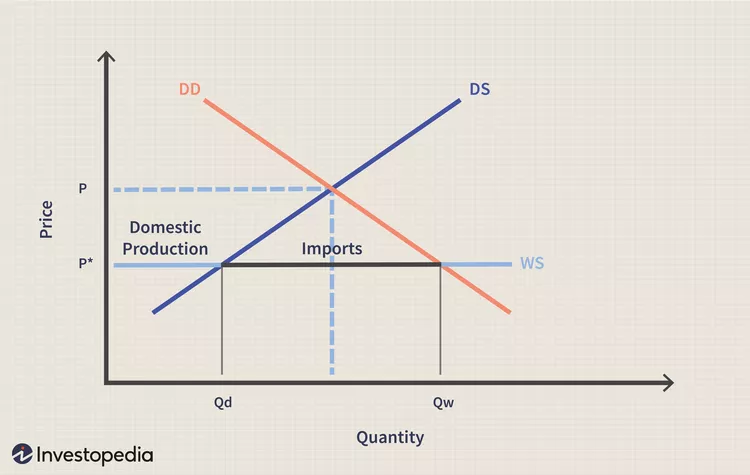

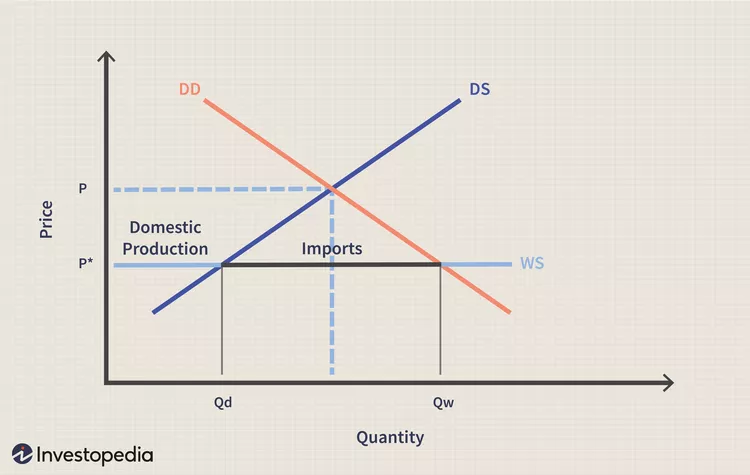

Let's look at the graph below. In this situation, the domestic price is P but the world price is much lower than that. Internationally, the competitive price is lower at P*. At this lower price, the United States will demand Qw quantity of the product, while only producing Qd quantity. This would lead to importing Qw-Qd amounts of the product.

Therefore, consumer surplus is maximized and no deadweight loss occurs. The consumer surplus would be the triangle undre the demand curve and above the world price P*(this is more Micro stuff! If you don't understand what this means, don't worry too much if you're not taking Micro!).

Image Courtesy of Investopedia

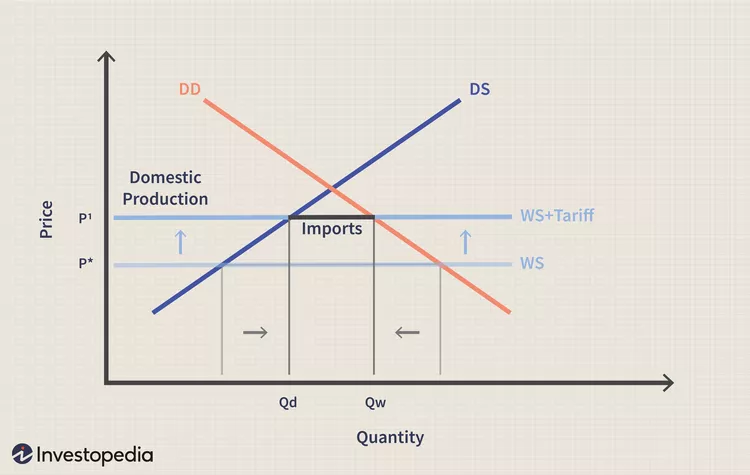

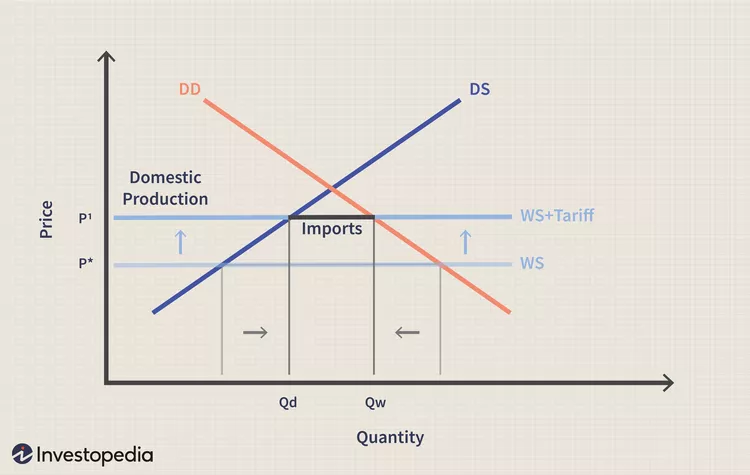

Now look at the graph below. A tariff has been imposed, increasing the price of the product for domestic consumers. Because a tariff has been imposed, now the distance between Qd and Qw are smaller, meaning less is bought through importing. Instead, more domestic producers are able to sell their products. However, because of tariffs, the price of the product has increased to P'.

Image Courtesy of Investopedia

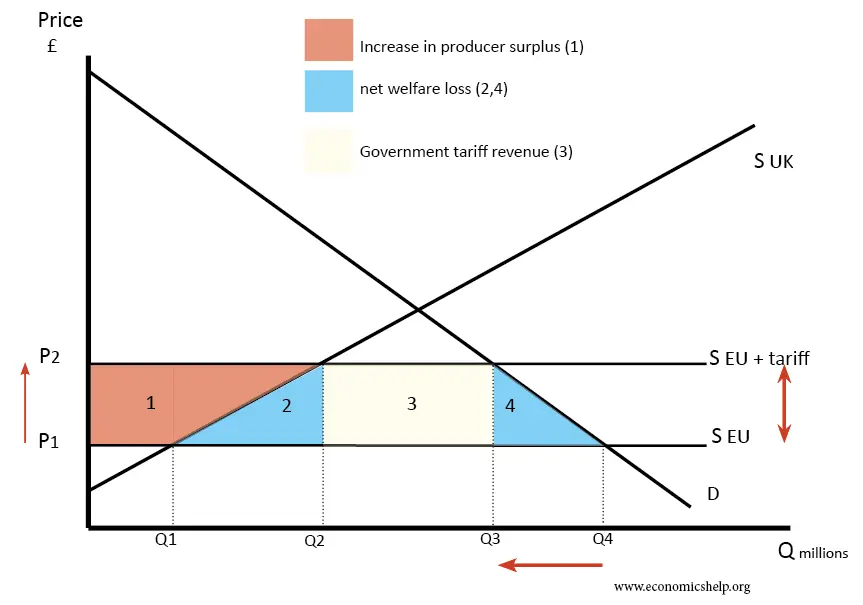

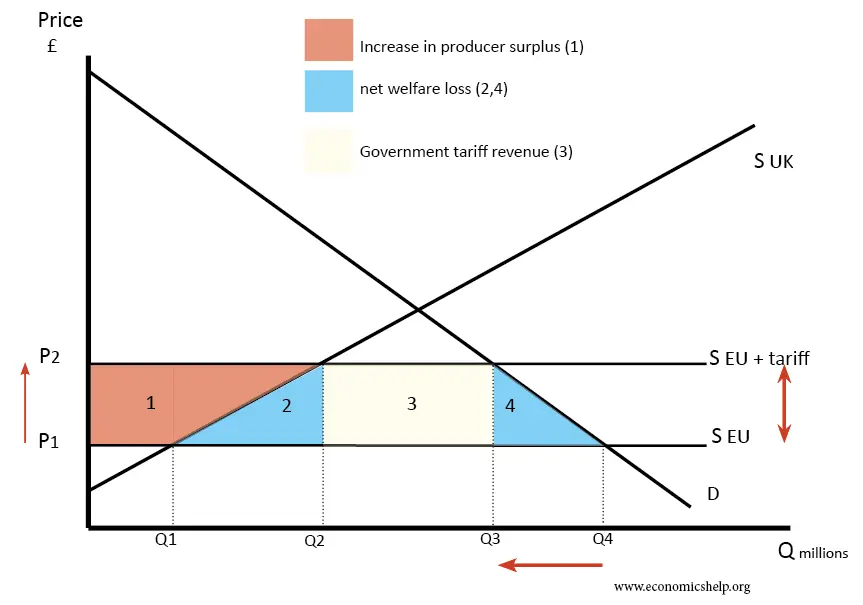

The graph below summarizes the effects of tariffs on a graph. Instead of demanding Q4 and domestically producing Q1 at the price of P1, we are now demanding at Q3 while domestically producing Q2 at a higher price of P2. The cream box represents the total government revenue (found by calculating the area of the rectangle) while the producer surplus of domestic producers have increased.

Image Courtesy of Economics Help

Economics Effects of Tariffs

There are a ton of economic effects with tariffs. Some include:

- Consumers pay higher prices while consuming less products- As seen in the graphs, the price goes up, amount of products imported and produced together go down.

- Consumer surplus is lost- Consumer surplus refers to the idea that the price of the market is lower than what they were willing to pay. Now, price is too high so that's gone.

- Domestic producers increase productivity and output- Now that domestic workers are protected, they are able to produce more.

- Imports decline- Well, we kinda saw that coming.

- The government makes revenue with tariffs- The area of the rectangle from the graph shows this. This is almost a transfer from consumers to the government for the product.

- Inefficiency - Unfortunately, when we don't operate at market equilibrium, we are working inefficiently. I mean, that's what equilibriums mean.

Quotas

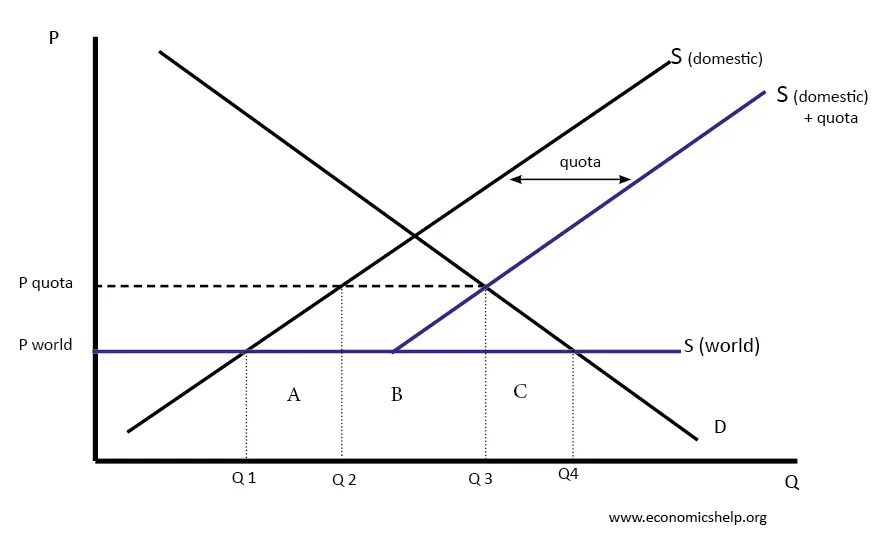

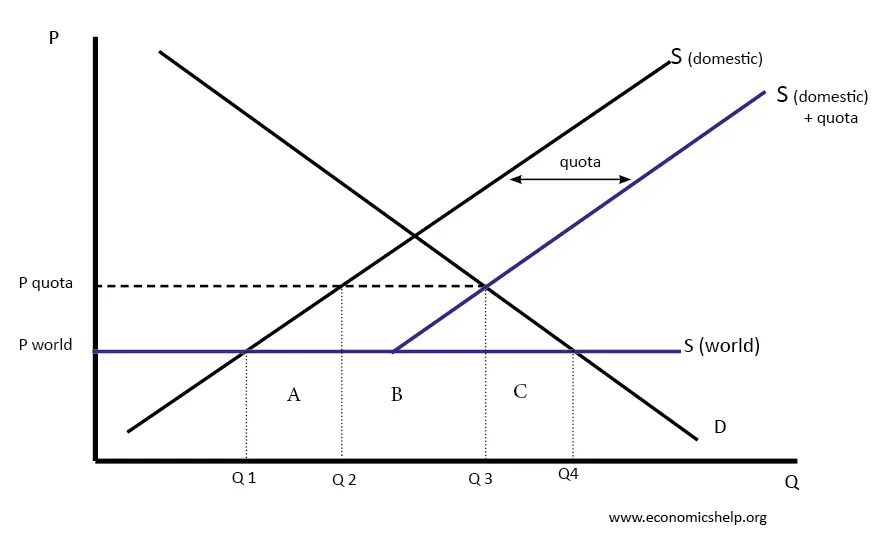

Quotas work in similar ways to tariffs. An import quota basically sets a maximum amount of goods that can be imported. Unlike tariffs, however, the government does not make an income, but other than that, a quota pretty much has the same effects as tariffs.

Image Courtesy of Economics Help

Without quotas, we would demand at Q4 and produce domestically at Q1, leaving Q4-Q1 for imports. However, since a quota was imposed, the supply shifts to the right. Now, the price is higher and we demand at Q3 while domestically producing at Q2. Imports now only comprise of Q3-Q2. The price of the product also rises from Pworld to Pquota.

<< Hide Menu

6.4 Effect of Changes in Policies & Economic Conditions on the Foreign Exchange Market

6 min read•june 18, 2024

Jeanne Stansak

Haseung Jun

Jeanne Stansak

Haseung Jun

Policies and the Foreign Exchange Market

Change in Demand or Supply in Currency

There are four determinants that can change either the supply or demand in the FOREX Market. These include:

Let's look at some scenarios that fall into these different determinants and see how they affect the various currencies.

-

Scenario # 1: Tourists from all over the world travel to Mexico for Vacation.

-

The demand for the peso will increase and the peso will appreciate. Appropriately, demand will shift to the right.

-

Scenario # 2: The price of U.S. exports increase. How would this affect the demand for the U.S. dollar?- It would cause the demand for U.S. goods to decrease which would cause the demand for the dollar to decrease. The U.S. Dollar would depreciate. Appropriately, demand will shift left.

- Scenario # 3: An economic boom causes income levels to increase for Chinese consumers causing them to increase their demand for Germany goods.- The demand for the Euro will increase, as they need to convert the Yen to Euros. The Euro will appreciate because a shift of demand to the right.

- Scenario # 4: Japanese real interest rates are higher than interest rates in the United States.- The demand for the Yen will increase and the Yen will appreciate.

Fiscal Policy Impact on Exchange Rates

When the government practices an expansionary fiscal policy (increase in spending or decrease in taxes), there is an effect on the exchange rate for that country's currency. The example below shows what would happen if this occurs in the United States.

If the government increases spending or decreases taxes, aggregate demand (AD) will increase, which will increase real GDP output and increase the price level. This makes U.S. goods more expensive which means that other countries will not buy as much. So, there will be less of a demand for the U.S. dollar which will depreciate it.

When the government practices a contractionary fiscal policy (decreases spending or increases taxes), there is an effect on the exchange rate of that country's currency. The example below shows what would happen if this occurs in the United States.

If the government either decreases spending or increases taxes, that will decrease aggregate demand which will decrease real GDP output and decrease price level. This will make U.S. goods less expensive which will make them more attractive to foreign consumers. Foreign consumers will increase their purchases of U.S. goods and will need to exchange their currency for the dollar which will increase the demand for the dollar. When the demand for the dollar increases, the value of the dollar will appreciate.

Monetary Policy Impact on Exchange Rates

If the central bank of a country is practicing an expansionary monetary policy (decreasing the reserve ratio, decreasing the discount rate, or buy bonds) it will have an effect on the exchange rate as well. In the following example, we are looking at the actions of the Federal Reserve in the United States.

When the FED increases the money supply, that lowers the interest rate which will increase investment spending. When investment spending increases, aggregate demand increases which raises the price level. This means that both the national income levels and export prices will increase. With the U.S. good at higher prices, foreign customers do not want to buy the goods which will decrease the demand for the U.S. dollar, causing a depreciation of the U.S. dollar.

If the central bank of a country is practicing a contractionary monetary policy (increasing the reserve ratio, increasing the discount rate, or selling bonds), it will have an effect on the value of the exchange rate. In the following example, we are looking at the actions of the Federal Reserve in the United States.

When the FED decreases the money supply, that raises the interest rate which will decrease investment spending. When investment spending decreases, aggregate demand decreases which lower the price level. This means that both the national income levels and export prices will decrease. With the U.S. goods at lower prices, foreign customers want to buy the goods which will increase the demand for the U.S. dollar, causing an appreciation of the U.S. dollar.

Trade Barriers

Why do we have trade barriers? Most economists argue that free trade benefits both nations. So why do we have tariffs and quotas? Most economists say that's it's because it costs domestic jobs in the higher-wage nation.

China has a lower wage than the US. If China and the US have a free trade, many of American jobs will be lost because (remember supply and demand) more people in America will favor Chinese products over American products due to low prices (since China has low wages). This will lead to a decrease in profits for American businesses and workers will be laid off because firms will start cutting back on spending.

This is why trade barriers are mostly paced. It's to protect domestic jobs.

Trade barriers are not a Macro only topic, so if you're taking Micro too, you're gonna like it!

Tariffs

There are two types of tariffs. Revenue tariffs and protective tariffs. Revenue tariffs are taxes imposed on goods that were not produced domestically. These tariffs would be imposed on bananas, for example, since the US does not produce bananas. This wouldn't necessarily cause a big impact on the economy since the US doesn't produce bananas so there are no domestic jobs to protect. Instead, it's just there to raise government revenue.

Protective tariffs, on the other hand, are taxes imposed on goods that are produced domestically. These tariffs are the protect-domestic-jobs kind of tariffs.

Image Courtesy of Napkin Finance

Let's look at the graph below. In this situation, the domestic price is P but the world price is much lower than that. Internationally, the competitive price is lower at P*. At this lower price, the United States will demand Qw quantity of the product, while only producing Qd quantity. This would lead to importing Qw-Qd amounts of the product.

Therefore, consumer surplus is maximized and no deadweight loss occurs. The consumer surplus would be the triangle undre the demand curve and above the world price P*(this is more Micro stuff! If you don't understand what this means, don't worry too much if you're not taking Micro!).

Image Courtesy of Investopedia

Now look at the graph below. A tariff has been imposed, increasing the price of the product for domestic consumers. Because a tariff has been imposed, now the distance between Qd and Qw are smaller, meaning less is bought through importing. Instead, more domestic producers are able to sell their products. However, because of tariffs, the price of the product has increased to P'.

Image Courtesy of Investopedia

The graph below summarizes the effects of tariffs on a graph. Instead of demanding Q4 and domestically producing Q1 at the price of P1, we are now demanding at Q3 while domestically producing Q2 at a higher price of P2. The cream box represents the total government revenue (found by calculating the area of the rectangle) while the producer surplus of domestic producers have increased.

Image Courtesy of Economics Help

Economics Effects of Tariffs

There are a ton of economic effects with tariffs. Some include:

- Consumers pay higher prices while consuming less products- As seen in the graphs, the price goes up, amount of products imported and produced together go down.

- Consumer surplus is lost- Consumer surplus refers to the idea that the price of the market is lower than what they were willing to pay. Now, price is too high so that's gone.

- Domestic producers increase productivity and output- Now that domestic workers are protected, they are able to produce more.

- Imports decline- Well, we kinda saw that coming.

- The government makes revenue with tariffs- The area of the rectangle from the graph shows this. This is almost a transfer from consumers to the government for the product.

- Inefficiency - Unfortunately, when we don't operate at market equilibrium, we are working inefficiently. I mean, that's what equilibriums mean.

Quotas

Quotas work in similar ways to tariffs. An import quota basically sets a maximum amount of goods that can be imported. Unlike tariffs, however, the government does not make an income, but other than that, a quota pretty much has the same effects as tariffs.

Image Courtesy of Economics Help

Without quotas, we would demand at Q4 and produce domestically at Q1, leaving Q4-Q1 for imports. However, since a quota was imposed, the supply shifts to the right. Now, the price is higher and we demand at Q3 while domestically producing at Q2. Imports now only comprise of Q3-Q2. The price of the product also rises from Pworld to Pquota.

© 2024 Fiveable Inc. All rights reserved.