Browse By Unit

Jeanne Stansak

Jeanne Stansak

Monetary policy is actions of the Federal Reserve, by means of changes in the money supply and interest rates, that are intended to influence aggregate demand and change economic conditions.

Types of Monetary Policy

There are two types of monetary policy: expansionary monetary policy and contractionary monetary policy.

The first type of monetary policy is expansionary monetary policy, also known as easy monetary policy. The goal of this policy is to increase the money supply and increase real GDP output.

The second type of monetary policy is contractionary monetary policy, also known as tight monetary policy. The goal of this policy is to decrease the money supply and decrease real GDP output. The Federal Reserve has four different possible tools they can use to either increase or decrease the money supply.

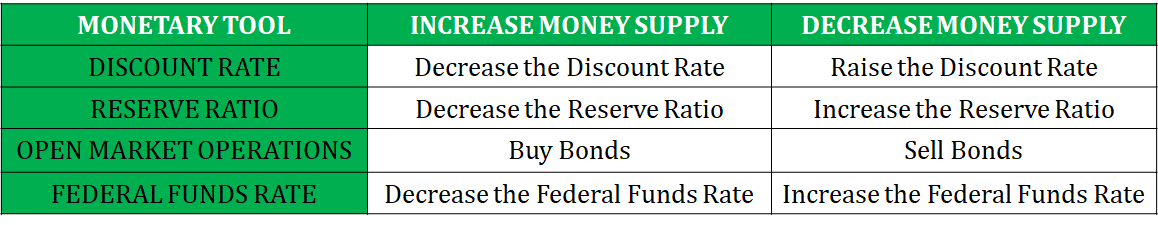

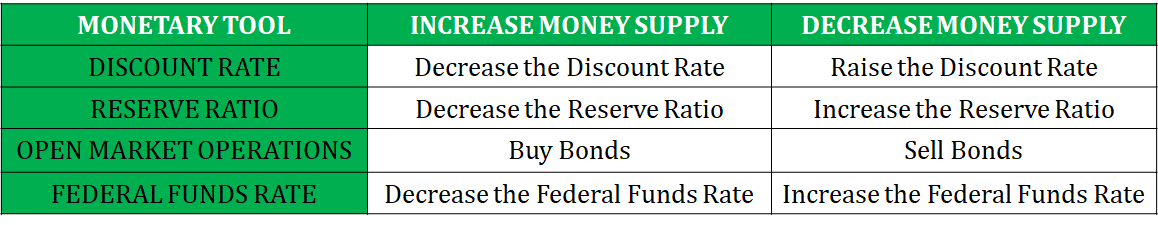

There are several tools that the Federal Reserve can use to influence the money supply. These tools include the discount rate, reserve ratio, open market operations, and federal funds rate.

The discount rate is the interest rate that the Federal Reserve charges commercial banks to borrow money directly from the Treasury. When the discount rate changes, it makes borrowing money more or less expensive for commercial banks. When the discount rate is low, banks will borrow more, which injects more money into the economy, increasing the money supply. When the discount rate is high, banks will borrow less, which injects less money into the economy, decreasing the money supply.

The reserve ratio, otherwise known as the reserve requirement, is the portion or percentage of all new demand deposits that banks must hold in reserve and cannot lend. If the Federal Reserve raises the reserve ratio, they decrease the money supply. This occurs because this allows less of a demand deposit to be put in excess reserves, and it cannot be loaned out. If the Federal Reserve decreases the reserve ratio, then they increase the money supply because this allows more of a demand deposit to be put in excess reserves, and it can be loaned out.

Open-market operations is probably the most popular tool used by the Federal Reserve in either increasing or decreasing the money supply. Open-market operations involves the buying and selling of treasury bonds. When they buy bonds, it increases the money supply by handing over new money to investors to exchange for the bonds (assets). When they sell bonds, it decreases the money supply because the investors hand over their money to the FED in exchange for a bond.

The federal funds rate is the interest rate at which commercial banks and depository institutions borrow money directly from each other. When the federal funds rate increases, it makes borrowing money more expensive. So, banks borrow less, which decreases the money supply and takes money out of the economy. When the federal funds rate decreases, it makes borrowing money less expensive. So, banks borrow more, which increases the money supply and puts money into the economy.

Effects of Monetary Policy

Monetary policy is the Federal Reserve's way of correcting the economy. When the economy is either in a recessionary gap or an inflationary gap, the Federal Reserve can try and correct the economy by either increasing or decrease the money supply. They will practice expansionary monetary policy when the economy is in a recessionary gap in an effort to get the economy moving again and bring it back to equilibrium. They will practice contractionary monetary policy when the economy is in an inflationary gap in an effort to slow down the economy and bring it back to equilibrium.

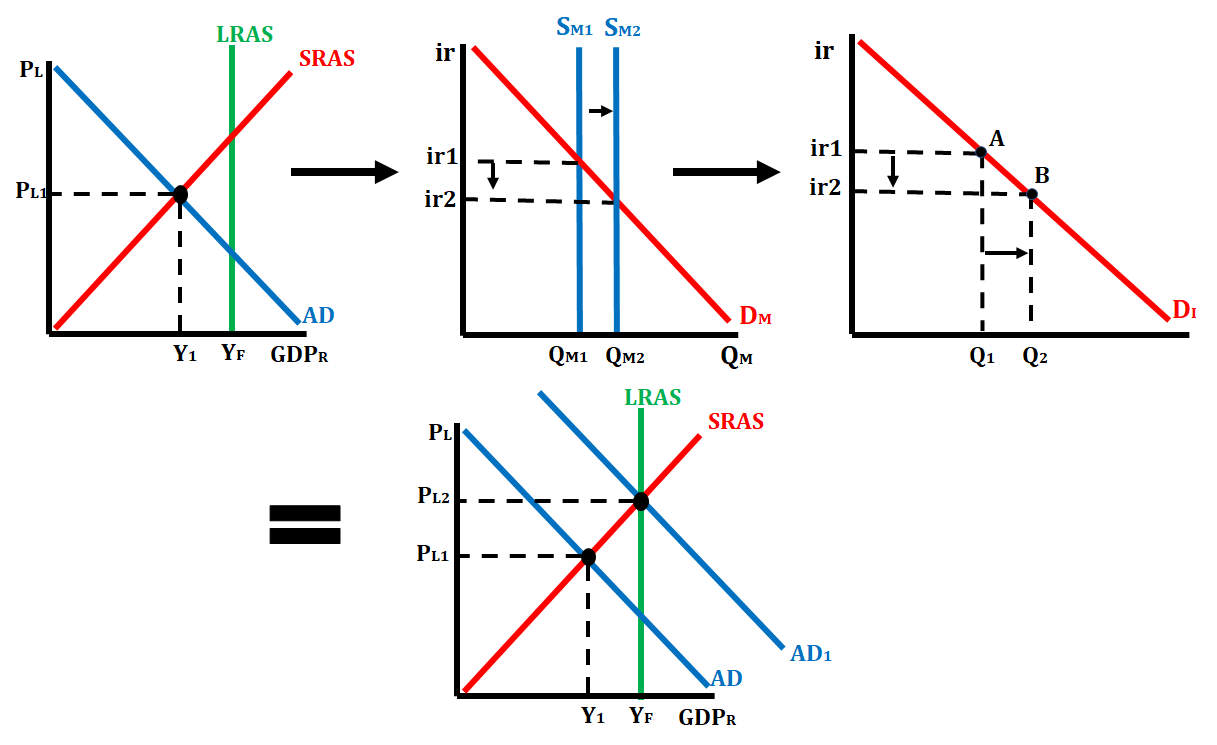

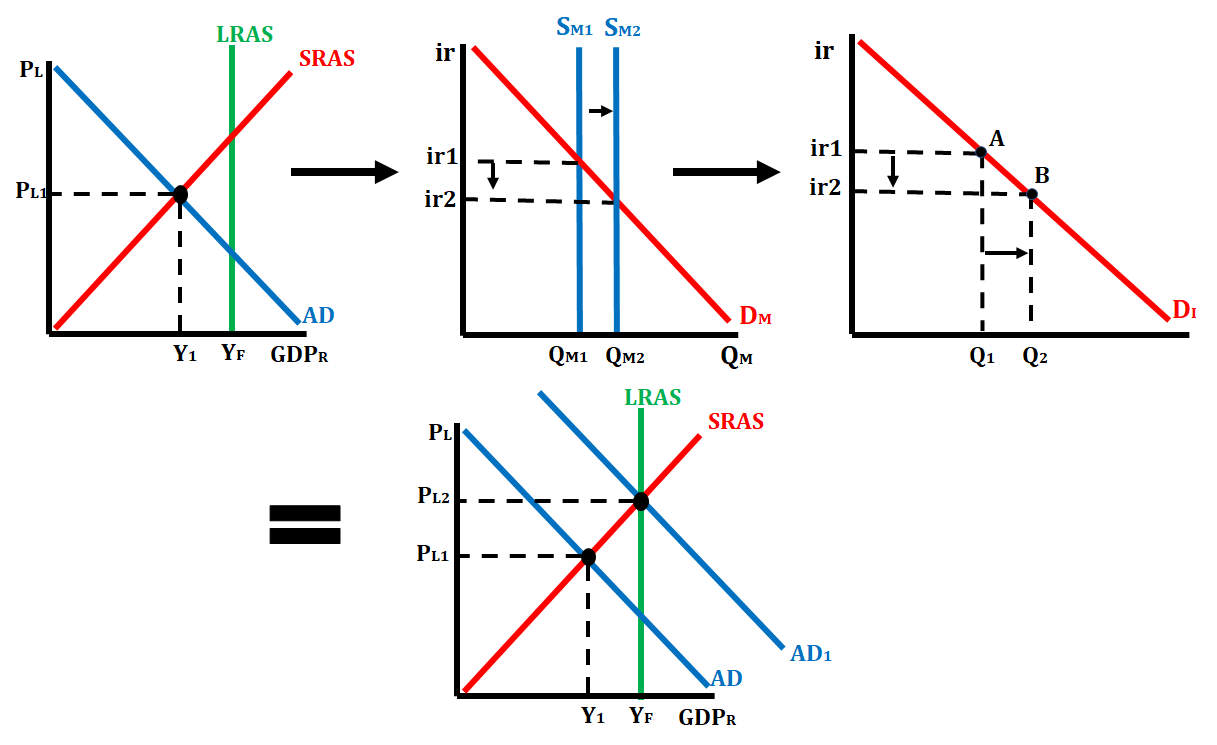

Recessionary Gap to Full Equilibrium via Expansionary Monetary Policy

When the economy is a recessionary gap, the Federal Reserve will use monetary policy to increase the money supply in an effort to decrease the nominal interest rate. The lower nominal interest rate will lead to an increase in the quantity of investment demanded. As investment spending increases, aggregate demand will increase which brings the economy out of the recessionary gap and back to equilibrium.

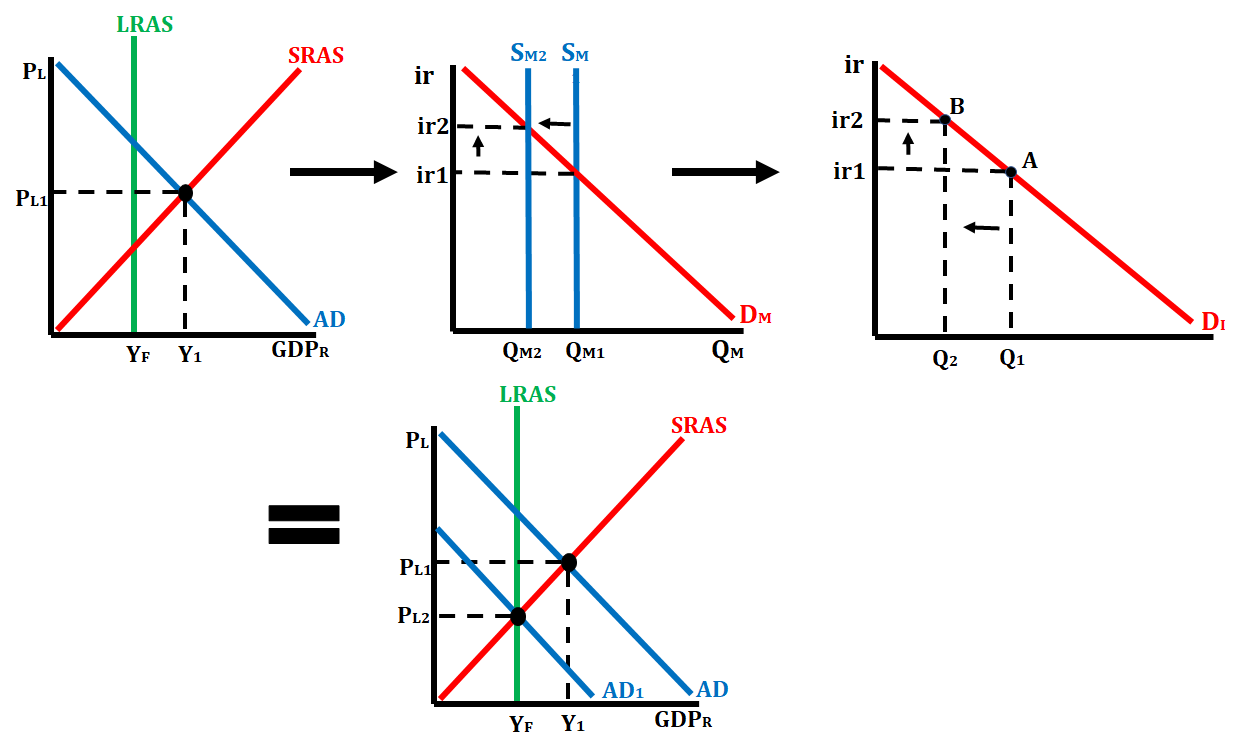

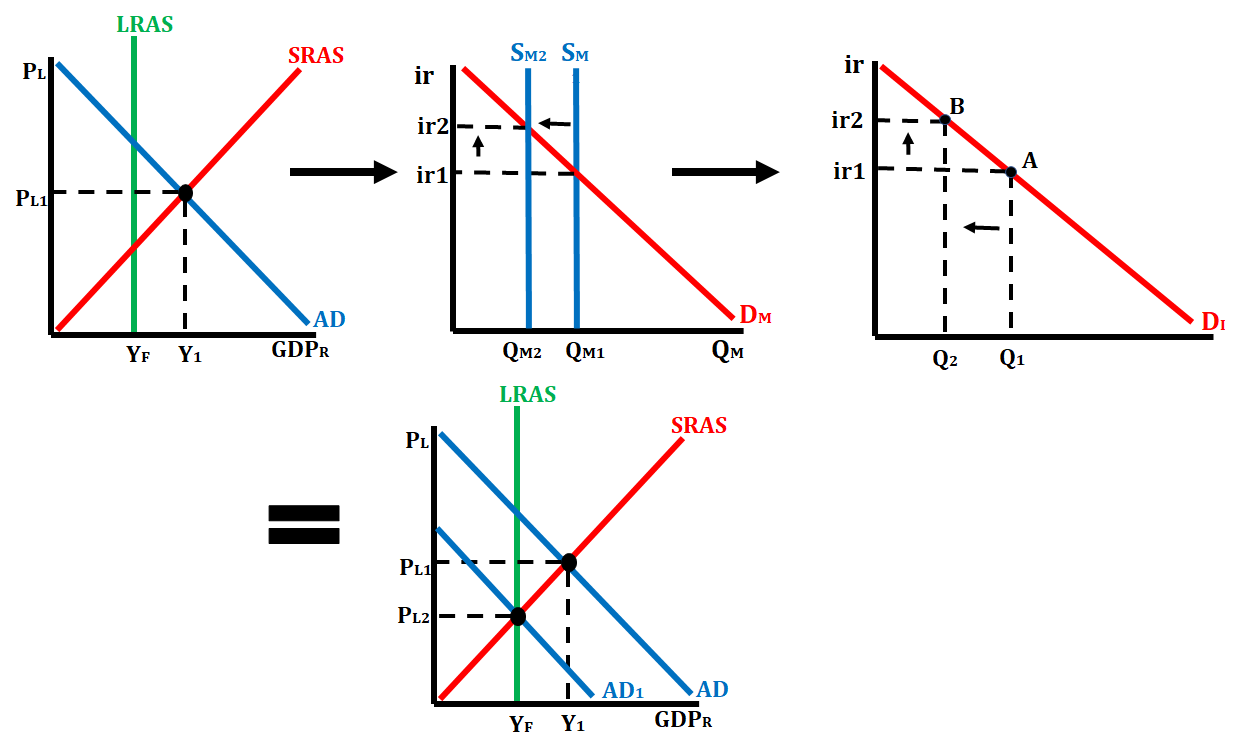

Inflationary Gap to Full Equilibrium via Contractionary Monetary Policy

When the economy is in an inflationary gap, the Federal Reserve will use monetary policy to decrease the money supply in an effort to increase the nominal interest rate. The higher nominal interest rate will lead to a decrease in the quantity of investment demanded. As investment spending decreases, aggregate demand decreases, which brings the economy out of an inflationary gap and back to equilibrium.

<< Hide Menu

Jeanne Stansak

Jeanne Stansak

Monetary policy is actions of the Federal Reserve, by means of changes in the money supply and interest rates, that are intended to influence aggregate demand and change economic conditions.

Types of Monetary Policy

There are two types of monetary policy: expansionary monetary policy and contractionary monetary policy.

The first type of monetary policy is expansionary monetary policy, also known as easy monetary policy. The goal of this policy is to increase the money supply and increase real GDP output.

The second type of monetary policy is contractionary monetary policy, also known as tight monetary policy. The goal of this policy is to decrease the money supply and decrease real GDP output. The Federal Reserve has four different possible tools they can use to either increase or decrease the money supply.

There are several tools that the Federal Reserve can use to influence the money supply. These tools include the discount rate, reserve ratio, open market operations, and federal funds rate.

The discount rate is the interest rate that the Federal Reserve charges commercial banks to borrow money directly from the Treasury. When the discount rate changes, it makes borrowing money more or less expensive for commercial banks. When the discount rate is low, banks will borrow more, which injects more money into the economy, increasing the money supply. When the discount rate is high, banks will borrow less, which injects less money into the economy, decreasing the money supply.

The reserve ratio, otherwise known as the reserve requirement, is the portion or percentage of all new demand deposits that banks must hold in reserve and cannot lend. If the Federal Reserve raises the reserve ratio, they decrease the money supply. This occurs because this allows less of a demand deposit to be put in excess reserves, and it cannot be loaned out. If the Federal Reserve decreases the reserve ratio, then they increase the money supply because this allows more of a demand deposit to be put in excess reserves, and it can be loaned out.

Open-market operations is probably the most popular tool used by the Federal Reserve in either increasing or decreasing the money supply. Open-market operations involves the buying and selling of treasury bonds. When they buy bonds, it increases the money supply by handing over new money to investors to exchange for the bonds (assets). When they sell bonds, it decreases the money supply because the investors hand over their money to the FED in exchange for a bond.

The federal funds rate is the interest rate at which commercial banks and depository institutions borrow money directly from each other. When the federal funds rate increases, it makes borrowing money more expensive. So, banks borrow less, which decreases the money supply and takes money out of the economy. When the federal funds rate decreases, it makes borrowing money less expensive. So, banks borrow more, which increases the money supply and puts money into the economy.

Effects of Monetary Policy

Monetary policy is the Federal Reserve's way of correcting the economy. When the economy is either in a recessionary gap or an inflationary gap, the Federal Reserve can try and correct the economy by either increasing or decrease the money supply. They will practice expansionary monetary policy when the economy is in a recessionary gap in an effort to get the economy moving again and bring it back to equilibrium. They will practice contractionary monetary policy when the economy is in an inflationary gap in an effort to slow down the economy and bring it back to equilibrium.

Recessionary Gap to Full Equilibrium via Expansionary Monetary Policy

When the economy is a recessionary gap, the Federal Reserve will use monetary policy to increase the money supply in an effort to decrease the nominal interest rate. The lower nominal interest rate will lead to an increase in the quantity of investment demanded. As investment spending increases, aggregate demand will increase which brings the economy out of the recessionary gap and back to equilibrium.

Inflationary Gap to Full Equilibrium via Contractionary Monetary Policy

When the economy is in an inflationary gap, the Federal Reserve will use monetary policy to decrease the money supply in an effort to increase the nominal interest rate. The higher nominal interest rate will lead to a decrease in the quantity of investment demanded. As investment spending decreases, aggregate demand decreases, which brings the economy out of an inflationary gap and back to equilibrium.

© 2024 Fiveable Inc. All rights reserved.